Économie et société

Les impôts en Europe

Le post

Voir sur

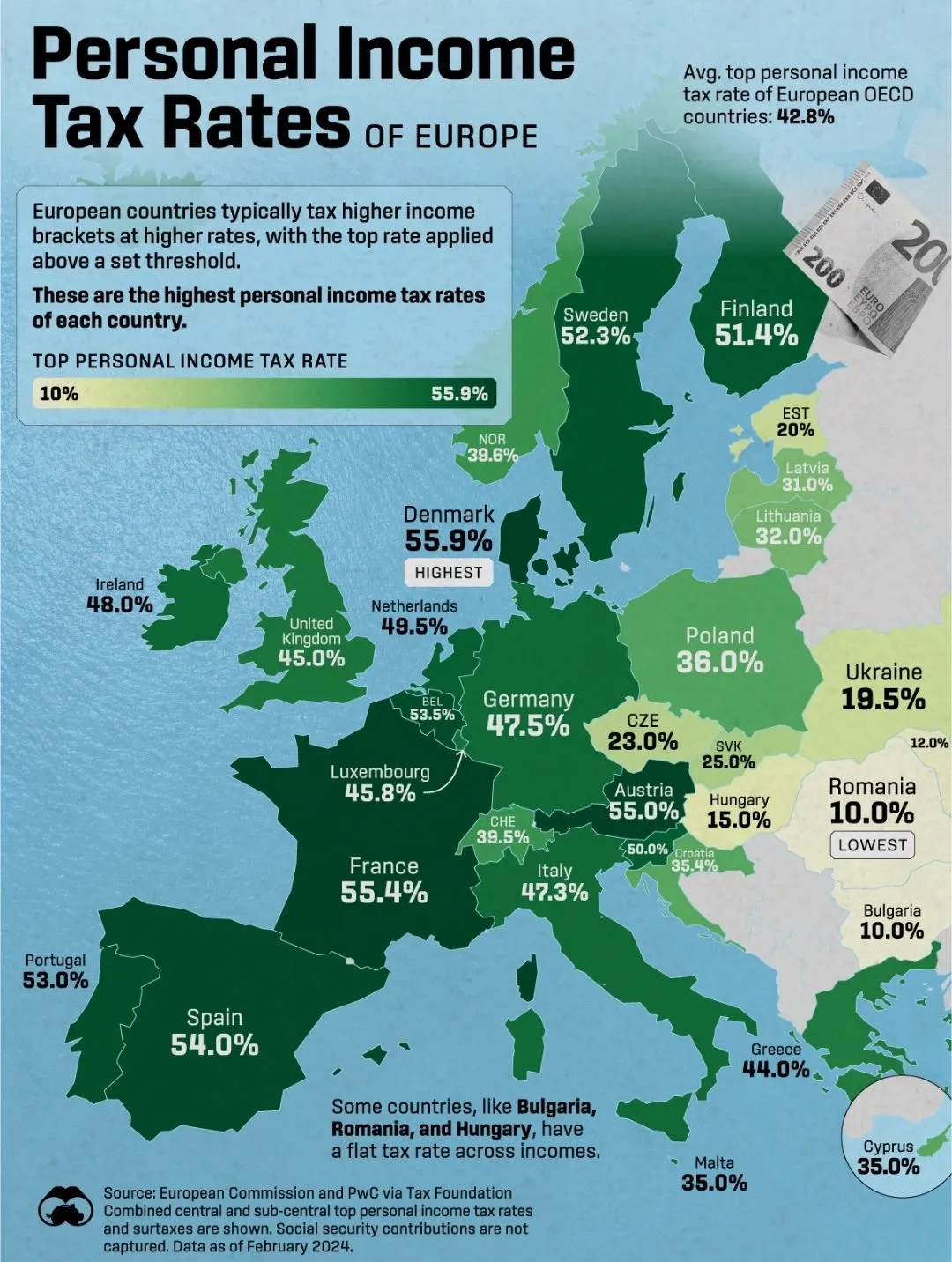

Denmark (55.9%), France (55.4%), and Austria (55%) have the highest rates, while Hungary (15%), Estonia (20%), and the Czech Republic (23%) have the lowest.

Le débunk

The values come from https://bit.ly/4eKgSnZ.

We could not confirm them due to the complexity of the computations involved (adding central and sub-central top PIT rates, surcharges, tax credits). It is nevertheless close to the nominal PIT rates (e.g.: https://bit.ly/4eH6iOy). Such a primary source is considered reliable and we do not have reason to doubt its accuracy.

However, the top PIT rate alone cannot express fiscal pressure without taking into account the inferior tax brackets which form the base on which the tax is levied. By definition, the top PIT rate only affects top earners, which is country-specific and does not represent the fiscal pressure for the average citizen. An illustration is available here: https://bit.ly/4iftVkj, with a rudimentary tax calculator here for a selection of countries: https://bit.ly/3ALBfDl.

Moreover, there is a long list of other types of taxes required to compute the effective fiscal pressure (capital income, VAT, social security contributions, etc). Among those, SSC are the most important. Those taxes are levied on labor and are paid by the employee and the employer, again according to the local tax code.

For a more in-depth comment on total fiscal pressure, see https://bit.ly/4g2BOr7.

Vous avez une question, une remarque ou une suggestion ? Contactez-nous en en indiquant le titre du débunk. Nous vous répondrons au plus vite !

Contactez-nous